11+ Trends and Statistics in Federal Contracting

Navigating the Labyrinth of Federal Contracts: Unveiling the Latest Trends and Numbers

In the ever-evolving world of federal government contract statistics and trends, understanding the latest statistics and trends isn’t just a luxury—it’s a necessity for those hoping to secure a piece of the multi-billion dollar pie. Each year, the federal government pumps vast sums into a myriad of projects and initiatives, making it one of the largest buyers of services and goods in the world. Yet, behind these colossal numbers lie fascinating patterns, emerging niches, and untapped opportunities that could shape the future of your business. Dive with us into the depths of the latest data, as we decode the intricacies of this expansive market and shed light on where the golden opportunities lie.

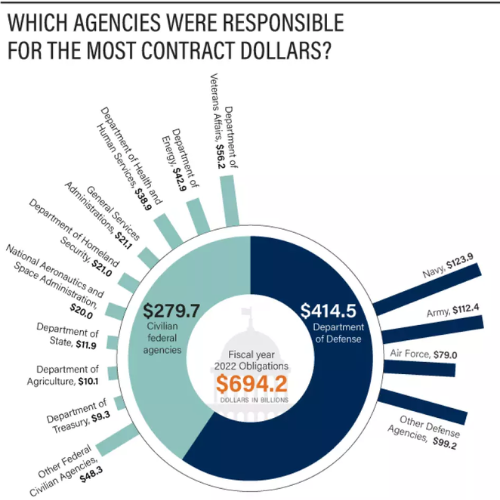

FY22 US Government Accountability Office

The federal workforce is tasked with a diverse array of responsibilities, yet federal agencies frequently partner with external firms and entities through contracts. These agreements facilitate the procurement of everything from airplanes and software solutions to catering services and medical care. In Fiscal Year 2022, federal contract spending reached approximately $694 billion, marking an inflation-adjusted rise of roughly $3.6 billion compared to FY 2021.

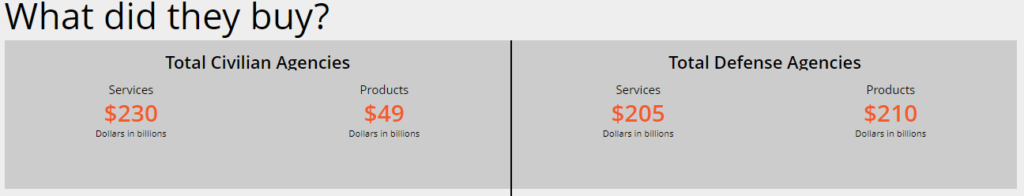

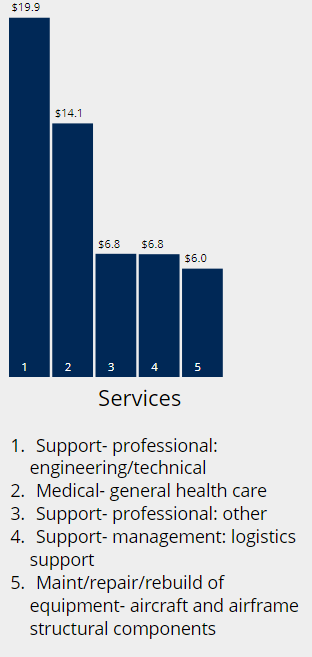

Top 5 Civilian Services and Products

Total obligations (in constant fiscal year 2022 dollars in billions)

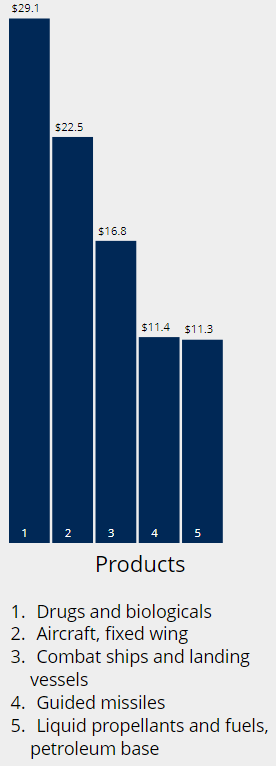

Top 5 Defense Services and Products

Total obligations (in constant fiscal year 2022 dollars in billions)

As in previous years, expenditure on services across the government surpassed

that on products. For two consecutive years, both defense and civilian agencies

have allocated the highest spending to drugs and biologicals.

As Threats Escalate, Advanced Technology Becomes Essential

To ensure the security of the U.S. defense and national security domains, vendors are tasked with enhancing hacking-resistant encryption. As quantum technology has the potential to decrypt files within minutes, critical data becomes increasingly exposed to cyber threats. Newly instated regulations mandate federal bodies to bolster the defenses of IT systems, especially those susceptible to attacks from computers more powerful than the current norms.

While companies in the U.S. are dedicated to elevating quantum cybersecurity, concerns arise regarding limitations on international collaborations. These restrictions, although designed to prevent U.S. technological aid to the Chinese government in mastering quantum capabilities, might inadvertently slow down encryption advancements domestically.

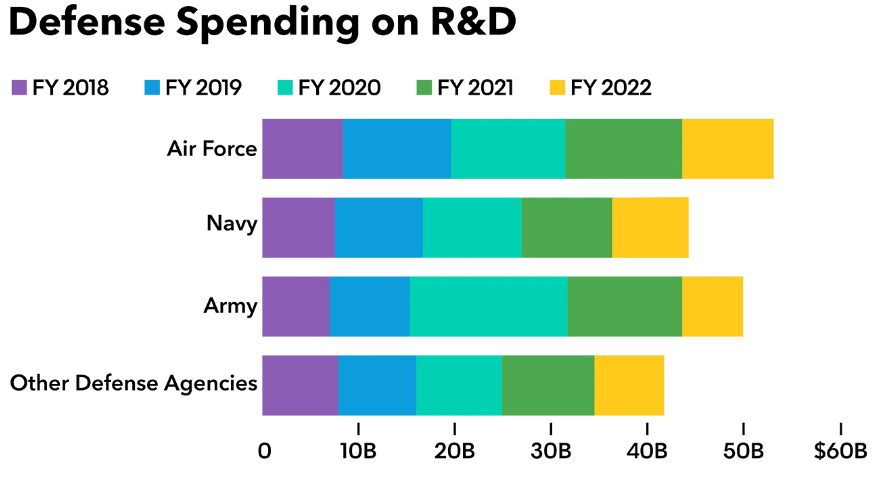

The Department of Defense (DoD) commits substantial funds each year, often surpassing tens of billions, to maintain an edge against global competitors. Hence, companies introducing novel technologies can anticipate sustained engagement. Between FY 2017 and FY 2022, the DoD’s R&D contract expenditure, amounting to $202 billion on non-classified contracts, exceeded that of all civilian agencies.

An unprecedented surge in R&D spending became evident from FY 2020, driven by the federal reaction to Covid-19, predominantly within the Army’s initiatives. The Army’s substantial procurement budget for Covid-19, nearing $7.6 billion, largely stems from an ongoing contract with Analytic Services Inc., now exceeding $8 billion.

Courtesy of Bloomberg Government

Companies operating in sensitive technology sectors reported that 61% of the threats they faced emanated from the Asia Pacific and Near East areas. As concerns about China intensify, there’s a noticeable uptick in DOD contract spending in Australia, echoing a broader U.S. military investment push in the Pacific region. The subsequent chart provides a breakdown of the top five vendors by revenue from contracts executed in Australia for FY 2022.

The defense alliance between Australia, the U.S., and the U.K. is heavily invested in advancing artificial intelligence and autonomous systems. Meanwhile, contractors specializing in large-scale weaponry are seizing opportunities, announcing both expansions and fresh contracts with DOD in Australia and the local government.

Federal Investment in Climate and Sustainability Initiatives Presents Potential Opportunities

Congress and federal bodies are gearing up to leverage advanced technology for climate readiness and sustainable initiatives. In recent times, the government’s satellite systems have actively tracked and addressed wildfires, droughts, and floods.

Through advanced sensing equipment, these satellites have identified greenhouse gas emissions, insights of which have been commercially used to predict the weather’s effect on agricultural produce.

The General Services Administration (GSA) – the country’s principal property custodian – is on track to power its 253,000 buildings entirely with renewable electricity by 2025. This commitment also extends to using eco-friendly construction materials for new edifices.

Parallel to the GSA’s efforts, the Army is steadfast in its dedication to green measures. Their strategy for FY 2023 to 2027 includes deploying electric chargers in combat zones, establishing microgrids on military bases, and initiating three in-house carbon-neutral power projects.

Top-tier Contracts Streamline the Procurement Process and Ensure Uniform Pricing

Top-Tier (TT) contracts are reshaping procurement practices. By breaking down age-old procurement barriers and introducing uniform pricing methodologies, they’re fast becoming a preferred choice for both agencies and vendors. Notable next-generation multi-award agreements like Alliant 3 and CIO-SP4 are paving the way for awardees into an era where “Top-tier or best in class” is the gold standard in governmentwide procurement.

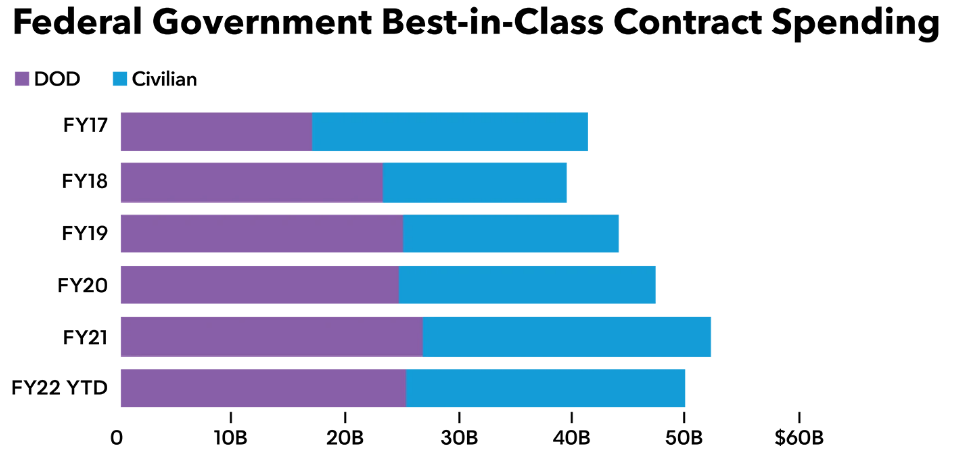

A look at the recent numbers reveals an insightful trend: TT spending has noticeably amplified over the previous five years. When considering both defense and civilian sectors, TT investment outpaces general contract outlays. For a clearer picture, from FY 2017 to 2021, the Pentagon’s TT expenditures ballooned at a rate 2.5 times that of the broader DOD budget. With this momentum, federal contractors should brace for an ascending spending curve in FY 2023.

Courtesy of Bloomberg Government

Agencies Require Increased Funding and Enhanced Collaboration to Modernize Antiquated IT Systems

In 2021, the pandemic relief stimulus legislation under President Joe Biden channeled a billion dollars to the Technology Modernization Fund (TMF), with the goal of transitioning from outdated to contemporary technology. Yet, the traditional yearly funding process lacks the agility required to update IT swiftly across the two dozen primary government bodies, each having distinct requirements.

Annually, these agencies allocate $100 billion on IT, of which a staggering 80% is directed towards maintaining current systems. These dated IT infrastructures not only demand steep upkeep costs but also expose weak cybersecurity defenses and heighten the demand for support from federal entities. TMF acts as a lifeline, providing agencies with funds that are expected to be repaid over a span of five years.

Government Contractors Must Place a Premium on Compliance

Contractors are now tasked with assessing their climate-related vulnerabilities, including potential legal issues and supply chain interruptions due to severe weather events, within their yearly financial disclosures. This change comes on the heels of President Biden’s announcement at COP 27 in Egypt, mandating large to mid-sized federal contractors to disclose their carbon emissions.

The openness of the U.S. innovation system has been lucrative for foreign players like China. In response, new measures have been implemented by federal agencies to evaluate the risks of foreign interference in small business contracting. While this may deter certain startups and academic researchers, it’s a necessary compromise to prevent China from gaining an upper hand through U.S. technological advancements.

In light of numerous cyberattacks, President Biden introduced an executive order in May 2021 to fortify the country’s cybersecurity infrastructure. This led to a surge in new regulations and guidelines. A notable 2023 rule regarding federal software procurement has sparked concerns among contracting departments and suppliers. This rule mandates software providers to furnish “self-declaration letters” confirming compliance with The National Institute of Standards and Technology (NIST) standards.

Demographic Insights into US Government Contractors:

Zippia has delved into the demographics of government contractors within the United States, leveraging a comprehensive database comprising 30 million profiles. To ensure the utmost accuracy, these estimates are cross-verified with BLS, Census, and real-time job listing data. Here’s a concise breakdown from Zippia’s data analytics team on the distinctive traits of government contractors:

- The US currently employs a robust workforce of over 5,138 government contractors.

- The gender distribution reveals that 45.4% are women and 54.6% are men.

- The median age for government contractors stands at 46.

- When looking at ethnicity, White individuals dominate at 70.6%, trailed by Hispanic or Latino (17.7%), Unknown (4.5%), and Black or African American (3.8%).

- As of 2022, women’s earnings stood at 93% compared to their male counterparts.

- The LGBT community constitutes 4% of the government contractor demographic.

- Intriguingly, government contractors are 67% more inclined to be affiliated with private entities rather than public ones.